Despite the coronavirus challenges the prospects of economic cooperation

between Ukraine and Hungary are urged to be developed

(from the Dmytro Kuleba and Péter Szijjártó telephone conversation, April 2020).

The context for Ukrainian-Hungarian cooperation is framed by two contrasting tracks of both countries geopolitical location: European integration and the Russian connection. Ukraine’s ultimate choice of European integration marked the start of a new stage of economic relations with Hungary. This was expressed in two contrasting tracks that have been defining the dynamics and content of their trade and economic cooperation since 2014. On the one hand, Hungary has been always supportive of Ukraine’s European integration ambitions, while on the other hand, Budapest had to balance its dependence on Russia in the energy sector that are of strategic importance to Hungary. Ukraine should address these circumstances in a constructive and pragmatic manner to maximize mutual benefits of economic cooperation with Hungary in areas of their common interests. The Belarus-Ukraine collaboration case, with their commitment to increase trade notwithstanding the different geopolitical aspirations, is a good example in that regard.

The paper builds on the results of the First Ukraine-Hungary Expert Forum and is elaborated in partnership by Ukrainian Prism and Institute for Foreign Affairs and Trade.

DOWNLOAD FULL REPORT

Institutional framework

There is no comprehensive and clear vision of Hungary as the strategic economic partner within the external economic policy of Ukraine. Hungary is not mentioned specifically in the official strategic documents of Ukraine. Nevertheless, upon considering critically important for Ukraine areas, it is Central and Eastern European countries that are referred to as the sample of economic and social development to be followed. Most notably, the National Security Strategy of Ukraine emphasizes the need to bring up closer to the social standards of Central and Eastern European states to ensure economic security. Creating the best among Central and Eastern European countries investment environment is determined as one of the key conditions for a new quality of Ukraine’s economic growth. The EU countries as a whole are mentioned among the markets which are potentially attractive for the majority of Ukrainian economy sectors. This is even with the essential differences in trade relations within country-specific contexts and the fact that Hungary is constantly in the TOP-3 EU countries in terms of merchandise turnover with Ukraine. Ukraine’s Export Strategy (“Road maps” of strategic trade development) issued in 2017 declares that Ukraine has to focus on the export of high-tech and innovative products in order to ensure the sustainable growth of the economy and gain a share of the world market via certain improvements both in the legal and in the production environment with a significant support of small and middle businesses which is a wise decision and we are ready to give a hand in such initiatives based on the experience we gained in the last decades. From the perspective of the current global and regional situation it is critically important to have sustainable and constructive cooperation among the neighboring countries especially if there are major possibilities of mutual benefits.

On the Hungarian side, the sixth chapter of the recently adopted new Hungarian National Security Strategy lists, among Hungary’s basic interests, the following (in section 88): “Hungary is interested in a strong, democratic, stable, economically developing Ukraine and balanced bilateral relations,

at the same time, legitimate efforts to strengthen the Ukrainian national consciousness must not be to the detriment of the acquired rights of the Hungarian minority.” In the first half of the sentence, Hungary stands by Ukraine. In the second half of the sentence, Hungary stands for the rights of the Hungarian minority living in Ukraine. The Hungarian government remains convinced that the protection and support of minorities is one of the cornerstones of democracy.

It is worth emphasizing here that the support and protection of Hungarian minorities in neighboring states has been the cornerstone of Hungarian foreign policy for decades, regardless of governments and political affiliation.

This has not been important since 2017 and especially not since 2014, as is sometimes claimed. Neighboring states have also been able to count on this consistent policy for decades. Speaking of the National Security Strategy, it is worth emphasizing that Hungary is committed to the Euro-Atlantic alliance. The Hungarian government stood by all common decisions and policies so far and will continue to do so. The relevant decisions and votes confirm this. According to the National Security Strategy, Hungary seeks just a balanced economic relationship with Russia within framework of norms of EU and NATO.

Ukrainian officials perceive relations with Hungary through the prism of European integration policy of Ukraine with little regard for bilateral and regional formats of institutional cooperation in the economic sphere.

In general, institutional cooperation with Hungary on economic matters is yet to be enhanced. The total trade turnover between the two countries in 2018 was nearly 3 billion USD, which is displays a 12% growth compared to 2017. The trade exchange between the two countries mainly focuses on raw materials, heavy machinery, energy and food products. The cooperation between Hungary and Ukraine has wider possibilities that the current conditions of European economy and cooperation strategies persuade us to reveal and develop.

Institutional economic cooperation has to be revived: there were only four sessions of the Ukrainian-Hungarian Economic Joint Intergovernmental Committee for economic cooperation (the last took place in 2013). To compare, the Intergovernmental Belarus-Ukraine Joint Commission on Trade and Economic Cooperation held 27 meetings, the most recent of which dates from the end of 2019. Due to the political tensions between Ukraine and Hungary opportunities to enhance regional trade and investment cooperation are being lost. In particular, the format V4+Ukraine that could provide tangible support, e.g. to small and medium business, remains frozen.

Lack of nationwide view and incoherence between positions of central and local authorities on mechanisms and targets of Hungarian financial assistance result in concentration of Hungarian projects in Zakarpattia oblast, which phenomenon is also rooted in the physical proximity of Zakarpattia to Hungary. That is often perceived ambiguously from the perspective of Ukrainian national interests.

Agreement on economic cooperation between the Government of the Republic of Hungary and the Cabinet of Ministers of Ukraine (2007) has no indication how to handle financial, donor or humanitarian assistance. Any type of assistance is either offered by Hungary (usually government) or asked by Ukraine (government, regional administration, city mayors, social infrastructure entities etc.). Since only governmental agreements are public, it is difficult to trace other forms of financial assistance, e.g. at the regional level.

Projects supported by the Hungarian government are present mainly in the Zakarpattia oblast, because of two main reasons:

- 1) there is still a relatively small Hungarian community (about 150,000 people) living in the region, and in line with Hungarian government policy to support Hungarians living abroad, they are the targets of various subsidies; while

- 2) Hungary borders Zakarpattia (which is not very well connected to the rest of Ukraine), therefore it is a logical entry point for Hungarian businesses trying to enter the Ukrainian market. As a result, these efforts have led to the increased integration of Zakarpattia’s labor resources into the Hungarian economy.

However, compared to the overall data, weight of personal remittances from Hungary in Gross Regional Product (9,4% in 2019) testifies to the highest reliance of the Zakarpattia’s economy from the Hungarian one as opposed to other Ukrainian regions (where the average value of personal remittances from Hungary weight in GRP is – 1%). It has to be noted though that the share of personal remittances to Ukraine has been 11.23 percent of the GDP in 2018, meaning that Hungary is not a major target country for Ukrainian labor force outflow (possibly also due to the language barrier which is easier to overcome for Zakarpattia citizens).

Points for improvement in bilateral economic relations

Against the backdrop of the positive changes in bilateral trade, caused by DCFTA start, key indicators of Ukraine-Hungary trade relations could be developed further. For one thing, the trade liberalization following the signing of the Association Agreement between Ukraine and the EU had a positive impact on Ukraine-Hungary trade dynamics. The growth rate of exports and imports between them outpace similar indicators between Ukraine and the EU. Compared to 2015 Ukrainian exports to Hungary increased by 70% (to the EU countries, on average, by 35%), import – by 50% (from the EU countries, on average, by 41%). Nevertheless, Hungary’s place among trade partners of Ukraine remains the same, completing the TOP-10. Neighboring Poland, for example, moved from being the fifth largest exporter from Ukraine to the second place. There was no apparent shift towards Ukraine’s merchandise exports diversification. Exports product concentration index – 0,5 (considering that it ranges from zero to one, with a larger value denoting a higher concentration of exports) tells us that a large share of a country’s exports to Ukraine is accounted for by a small number of commodities (compared to 0,19 concentration index to the EU as a whole). The first five sections within the Harmonized System Code accounted for 80% of exports. Although exports’ largest share was formed by the section with high value-added – “Electrical machinery and equipment and parts thereof”, main goods chapters in its composition (electric water heaters, wire and cable) are not highly advanced technologically. Positions of primary and resource-based groups (electrical energy, fuels, ores, wood) remain strong. There was no increase in the importance of other non-primary product groups (e.g. сhemical industry products or motor vehicles).

The openness of the Hungarian economy and technological structure of trade between Ukraine and Hungary create preconditions for their strategic cooperation.

The average value of the Offshoring Index (the value of imported inputs expressed as a share of total intermediate consumption) in Hungary is over 40%, which reflected a high level of its economic dependence on imported raw material and semi-finished products). Almost all the sectors are extremely or significantly affected by imports (e.g. manufacture of computer, electronic and optical products – 90%, manufacture of motor vehicles, trailers and semi-trailers – 84%, manufacture of textiles, wearing apparel and leather products – 77%, pharmaceutical and chemical manufacture – about 60%). Vertical specialization values also show the attractiveness of manufacturing sectors to Ukrainian exporters of intermediate goods. Preconditions for such cooperation should be confirmed by the technological cross-section of bilateral trade.

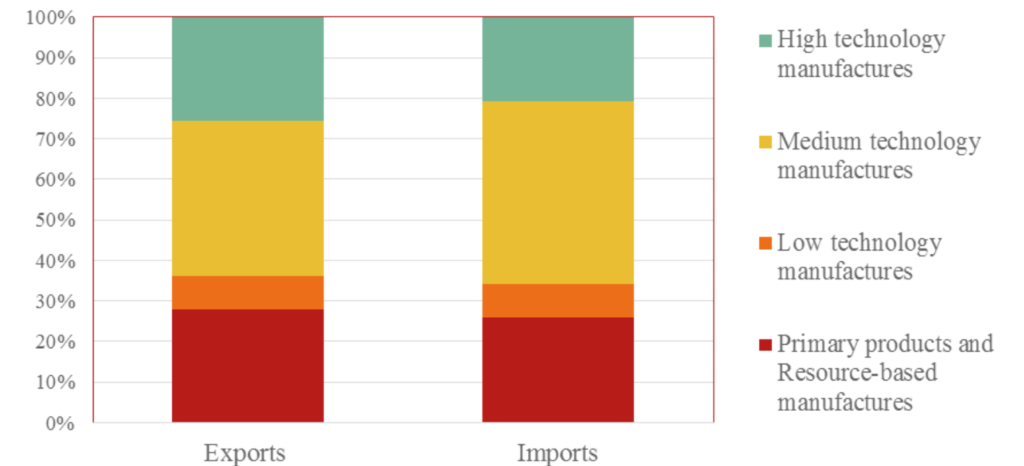

At first glance, Ukrainian exports to Hungary are commensurate by technological categories to the Hungarian one (Fig. 1). One-third (28%) of the value of all merchandise flows that move from Ukraine to Hungary accounts for primary products and resource-based manufactures. Nearly as much (25%) these technological groups constitute the structure of imports from Hungary to Ukraine. Low technology exports and imports have an equivalent weight (8%). 38% of Ukrainian exports to Hungary is provided by medium technology manufactures while such import accounts for 45% (the largest weight among all imported from Hungary to Ukraine trade items). The percentage of high technology manufactures’ exports (26%) is slightly above such imports (21%).

Fig.1. Technological cross-section of merchandise trade structure between Ukraine and Hungary, 2018*

*https://unctadstat.unctad.org

However, the overall picture of the exports’ competitiveness of Ukraine and Hungary (tab.1) demonstrates that Ukraine is ahead of Hungary only in primary products and resource-based manufactures (agricultural products, food, iron and steel).

Table 1

Comparison of Ukraine’s and Hungary’s exports position in merchandise trade, 2017

|

Commodity group |

Place of Ukraine among the exporting countries |

Place of Hungary among the exporting countries |

|

Agricultural products |

25 |

38 |

|

Automotive products |

66 |

20 |

|

Chemicals |

6 |

29 |

|

Clothing |

60 |

48 |

|

EDP and office equipment |

57 |

17 |

|

Food |

24 |

35 |

|

Iron and steel |

15 |

40 |

|

Machinery and transport equipment |

51 |

23 |

|

Pharmaceuticals |

64 |

19 |

|

Textiles |

60 |

36 |

Under these conditions growth of intra-industry trade between Ukraine and Hungary is more beneficial than inter-industry one because it stimulates innovation and exploits economies of scale. However, it should be noted that the vertical dimension of intra-industry trade has a bigger cooperation capacity, since the interests of its participants have many points of convergence. Horizontal dimension, in turn, entails more risks of rivalry or even fight, owing to the parties’ opposed interests. Moreover, mutually beneficial vertical cooperation by non-primary products may contribute to the competitiveness of exports from Ukraine, thereby ensuring the comprehensive modernization of the national economy. Thus, the increase in the number of business entities with common economic interests is the key to the pragmatization of bilateral relations agenda, mitigating political tensions.

Intra-industry cross-section of Ukraine-Hungary trade specifies the design of the win-win model of their economic cooperation which is the start point to consider in external economic policy implementation.

Comparison of specific indicators of international trade revealed such features of the current model of trade cooperation between Ukraine and Hungary:

- the overall level of intra-industry trade is above the average (0,6 on average on a scale from zero to one) and tends to slowly increase, testifying gradually strengthening their economic integration. There is a high level of mutual exchange of trade flows in resource-based and low technology manufactures, as well as in medium technology manufactures (except for automotive) and high technology manufactures: electronic and electrical;

- a more in-depth analysis of exports and imports dynamics (marginal intra-industry trade indexes for 2014-2018) within individual sectors demonstrates the prevalence of horizontal cooperation in low technology sectors of food and non-food agriproducts, textile, garment and footwear production etc. This means that the products exchanged between Ukraine and Hungary are equivalent in terms of technological completeness and thus value-added. Their different quality features (for example, brands of the clothes or food products with special qualitative, innovative features) attract customers on both sides of the border. And Ukrainian manufactures have relatively high productivity within listed trade items. Therefore, fare competition is possible solely through search and occupying the niche among Hungarian consumers, otherwise, trade protection measures (anti-dumping, anti-subsidy investigations) will be taken. The same applied to the trade exchange of items within the group “High technology manufactures: electronic and electrical”.

- cooperation between medium technology manufactures (process and engineering), despite its vertical nature, is receding from the perspective of Ukrainian manufactures productivity. This is where governmental support for Ukrainian producers is decisive. To define which commodity groups of Ukrainian production at the level of HS4 are promising for export to Hungary further analysis should be provided, notably the revealed comparative advantage indexes for the countries and gravity model of their trade.

There is an essential capacity for the inclusion of Ukrainian producers in the global value chain through vertical cooperation with Hungarian companies within the production of motor vehicles and pharmaceuticals.

Intra-industry trade of these trade items between Ukraine and Hungary is now at a near standstill. For their part, Ukrainian companies are ready to scale up production of goods, the quality of which meets European customers’ expectations. The increase in spark plugs exports can be provided by way of example. Their supply to the EU jumped by one quarter and placed second in the monetary equivalent exports. This became possible owing to the investment flows into enterprises targeted at spare auto parts production. Since 2015 nine new plants that produce automotive cable products have being opened in Ukraine. And yet, just like before, Ukrainian goods, imposed on labour-intensive manufactures, not on technologies, are in industrial demand in Hungary, like in the EU in general (such as mentioned above cable production technology boils down to wire twisting and their junction with plastic ties). Ukraine still cannot boast of really technological exports. There are only small-scale start-ups (e.g. drones and electric bikes) exporting small shipments among the companies which trade with the EU.

Despite the crucial role of foreign investment in boosting medium and high technology production activity of Hungarian investors in Ukraine is hampered by a number of internal and external factors.

In 2019 Hungary was a TOP-14 investor in Ukraine with USD 380,7 million of accumulated direct investment. According to the most recent available data (May 2020) there are 833 companies owned by residents of Hungary. The majority of them are registered in Zakarpattia, Kyiv, Odesa, Lviv, Ivano-Frankivsk and Dnipro regions. And yet, there were no major investment projects which can be mentioned during the last years on the Hungarian part. Except for one pellet production project in the Zakarpattian region in Tyachiv/Técső, where USD 11mln were provided for expanding of the manufacturing facility of pellets. The following SWOT analysis provides a quick overview of perspectives of Hungarian investors regarding Ukraine:

- Strengths: Ukraine has well developed and wide spread heavy industry. Over 25% of the population is employed by manufacturing companies involved in mining, railway rolling stock, energy, farm equipment, road construction equipment, machine tools, aircraft engines, instrumentation and manufacturing for the light and food industries. Another major segment of the Ukrainian economy is agriculture which employs nearly another 25% of the entire employed population. Over 70% of the country’s total area is agricultural land. Ukraine has favorable geographic location which places it in a temperate continental climate zone with adequate access to water and transportation networks and domestic agro-tech manufacturing of the needed machinery with major plants located around the country. This very geographic location makes Ukraine to be the gate to the East – a significant advantage that combined with the well spread network of railroads (22 000 km) and highways (170 000) makes the country a major supplier for cargo transportation services. Ukraine demonstrates a serious growth in the IT field. Today IT outsourcing is Ukraine’s third largest export sector. All of the above is reinforced with a high percentage of educated professionals in each field provided by the strong specified education system. The average salary for the IT specialist is lower compared to India or China which allows to invest or outsource businesses to Ukraine rather than to the far East.

- Weaknesses: Despite the impressive capacities, the Ukrainian economy struggles with low productivity and cost efficiency. Even though the heavy industry undergone major changes and became more diversified, many of the main Ukrainian products lack competitiveness on the European market: the poor quality, often outdated equipment and technologies the slightly hectic manufacturing processes are the main reasons why potential marked might be not satisfied. The significant amount of industrial waste, in the extensive supply and energy consumption of the manufacturing process lead to the weak cost efficiency. Despite the relatively low salaries to be paid to the employees the production itself seems to be too expensive compared to the quality of the products. The extensive network of railroads and highways many times is not maintained well enough. The quality of the international highways in many cases is poor, that slows down the shipment. The current state of the railroads needs to be improved as the current railway transportation is slow due to the outdated locomotives and the railroads themselves that can’t bare high speed cargo traffic. The conditions for the small and middle business are not clarified and the support system is having numerous uncertainties.

- Opportunities: Every weakness is also an opportunity in a way. By detecting certain weak points, we have the opportunity to determine the crucial points of cooperation such as sharing best practices or involve funds for modernization of the manufacturing process, or to increase the already impressive productivity of the agriculture even more. Thanks to the affordable labor costs Ukraine provides a significant market for numerous branches of already existing business in Hungary such as assembling factories, plastic and household waste recycling facilities, outsourcing IT services such as database management, server support, programming and IT infrastructure design. By a clear and understandable financial support model we can increase the competitiveness of the Ukrainian products in Europe and the region. This can allow to establish an alternative supply chain of goods and recourses in the V4+ region that in the current conditions of border closure due to the COVID-19 pandemic is more than a justified need. Establishing an efficient regional economic cooperation is not only a temporary solution it is also a proper way to gain the required level of trade and long term financial benefits.

- Threats: The unstable political situation, the armed confict on the East of the country, the slow implementation of the economic refomes, the high level of corruption makes Ukraine least popular among the investors. One has to keep in mind the often unclear conditions of VAT reimbursement for the imported goods for the prioritised green energy projects for example and the list can be extended with the bueraucracy on local levels. The Global Competitiveness Index of Ukraine in 2019 was 56,99 out of 100 which makes it the 85th most competitive country in the world out of the 140 ranked. In the rank of the Hungarian Eximbank Ukraine is rated in category 6 (out of 7 where we find countries like Venezuela, Zimbabwe, Sudan, Afghanistan etc.) which makes difficult to gain the financial support for major investments.

For Hungarian companies and other EU investors the war in the East, the macroeconomic situation, slow economic growth, corruption, risks of protection of the property rights are among the main barriers discouraging investment. Because of unfavourable market conditions several big players left the market (e.g. MOL), others interrupted their investment projects (e.g. Masterplast) and many investment intentions were removed from the agenda (Graboplast, MVM). The areas of interests for the most important Hungarian investors are financial services (OTP Bank Group), pharmaceuticals (Richter, Egis), construction (KÉSZ Holding, Masterplast), agriculture and food industry (Penograin, Agrofeed, Hell Energy), machinery industry (A-Lap), air transport (WizzAir).

Improvement of cross-border infrastructure offers great possibilities for economies of both countries but their financial capacity is not sufficient to ensure the realization of such projects.

Since the inception of the bilateral relations between Kyiv and Budapest the improvement of cross-border infrastructure is the topic that the governments have prioritized. The international transport corridor between Ukraine and Hungary connects not only their markets but European and Asian as well. Wherefore, Transcarpathian development projects could provide an additional impetus to broader regional cooperation, aside from bilateral trade.

The efficiency of the transport sector depends a lot on the infrastructure. Today there is one cargo railway crossing point and one border crossing point for trucks available on the Ukrainian-Hungarian border. While the cargo railway works relatively efficiently despite the differences of the railroad standards thanks to the 7 reloading terminals located in the Trascarpathian region (according the protocols of the joint Russian-Ukrainian-Hungarian-Serbian cargo transit and transportation committee issued in 2016 the 7 terminals have the capacity to reload 518 wagons of various goods a day), the trucks terminals are suffering major delays due to the low efficiency of the border crossing. There is already an ongoing project of a truck terminal on the Beregsurány-Luzhanka border crossing point. Hungary is open to discuss the possibilities of further developments of border crossing points that would ensure the fluent and uninterrupted cargo transportation. These activities however would need further developments of the highway network in the border region – first of all construction of city bypass roads so that the increased amount of cargo carrying trucks avoid the cities. As a significant increase of cargo transportation is expected on the Hungarian railways and highways due to the involvement of ports of Koper and Trieste in to the Central European trade.

In order to build more border crossings and enhance the system of railway transportation several joint actions have being launched. Some of them have being fulfilled by the Hungarian side, but the lack of resources from the Ukrainian side hampered their implementation further in Transcarpathia. Moreover, large-scale development projects are mainly funded by international financial institutions (like the World Bank). Access to that funding requires extensive experience, a solid reputation and a strong capacity to guarantee such actions. A possible option might be the formation of consortia or other reputable forms of collaborative arrangements among East European countries that facilitate access to larger sources of potential financing.

Recommendations

Based on mutual economic interest, enhanced bilateral trade and investment relations have the possibility to defuse a politically loaded discourse between the governments of the two respective countries.

- 1. On the strategic level it would be beneficial to highlight the comprehensive direction of the external economic policy of Ukraine concerning Hungary in the strategic official documents. First of all, this concerns a new version of the Export Strategy of Ukraine that will change the current Strategic Trade Development Roadmap in 2022. Indicators of openness of economy testify the attractiveness of manufacturing sectors of Hungary to Ukrainian exporters of intermediate goods. To identify the most promising commodity groups to be exported to Hungary further analysis is needed. As the indicators of successful achievement of its objectives and activities regarding Hungary it would be worthwhile to define such figures of foreign trade “quality” as product concentration index of exports, technological level of TOP-10 sections within Harmonized System Code, weight of the non-primary goods in exports.

- 2. The next major step is a resumption of the medium-term programming of the joint economic activity in the bilateral and regional formats of institutional cooperation. This requires the reanimation and substantiation of the sessions of the Ukrainian-Hungarian Economic Joint Intergovernmental Committee for economic cooperation. The same increased attention should be paid to the reactivation of the Ukrainian-Hungarian Intergovernmental Commission on Cross-Border and Border Cooperation. Within the Commissions’ work not only such pressing topics as building new checkpoints, highways, and transportation hubs require exploring. Focusing exclusively on the border region of the two countries can jeopardize other issues on the agenda. Hungarian support projects in Transcarpathia should be regarded as something that connects rather than separates the two nations. Hence, improvement and enhancement of cross-border cooperation can and should open up new options to extend the scope of interest. Notably, it is worth extra effort to “unlock” V4+Ukraine format, as well as to reach a preliminary agreement on possible consortiums between V4 countries and Ukraine. This aims at full-fledged inclusion of Ukraine in the regional infrastructure projects (as a platform to discuss details of such initiatives Business Forum of the Three Seas Initiative can be suggested), therefore embodying European integration not only declaratively, but practically.

- 3. While selecting forms and instruments to strengthen Ukrainian exports in the Hungarian market at the level of government trade policy, the relevant state of bilateral economic cooperation deserves closer attention. Currently, there are two foundational directions to establish the win-win model of trade via government regulation measures: on the one hand, it is support for an increase of Ukrainian manufacturers’ productivity that are perspective in terms of vertical cooperation with Hungarian entrepreneurs; on the other hand, it implies that Government must refrain from regulations likely to escalate the rivalry in the sectors with horizontal cooperation prevailing. Further development of exports promotion policy should be based on Ukraine’s capacity to be involved in the global and regional value chains through vertical cooperation with Hungarian companies. Now substantial spare capacity to do so exists in the areas of motor vehicle production and pharmacy.

- 4. Within bilateral economic relations microeconomic diplomacy requires special attention. Вilateral business-forums previously created the favourable atmosphere for the establishment of mutually beneficial cooperation. That is why the positive practice of Ukrainian-Hungarian business events (both general and specialized) would be appropriate. A good example is the successful holding of the forum in Debrecen in 2016 that became the biggest among similar bilateral events with the participation of Heads of governments. Ukrainian Government could offer such a vast action in Ukraine after quarantine measures relaxing, to wit, with a support at the highest political level (under the patronage or in conjunction with the visits of head of state or government).

- 5. Considering the problematic investment climate in Ukraine, it is wiser to implement a model of targeted balancing. It means that in an effort to attract investment across economic sectors the preferences of Hungarian investors and concurrently national interests should be taken into account. Although, it is hard to name any specific companies, which now reveal interests to invest in Ukraine, one can take up the Egán Ede Program for Zakarpattia worked out by the Hungarian government. Namely, the following sectors of Ukraine’s economy are listed there: agriculture, food processing (fruits and milk), and tourism (construction of hotels and thermal mineral water complexes). Moreover, as is known Hungary aims to achieve 20% “clean” energy by 2030 and actively works on decarbonization. Sustainable development issues are also a priority for Ukraine. So, there is plenty of opportunities to develop green investment projects, in particular, the implementation of joint renewable energy projects and the stimulation of energy efficiency of industrial enterprises.

- 6. The most efficient way of the infrastructural developments and sharing best practices is the system cross border cooperation. Ukraine is already involved in numerous projects within the frame of the Hungary-Romania-Slovakia-Ukraine (HUROSKUA), Poland-Belorussia-Ukraine (PLBYUA) and Romania-Ukraine (ROUA) European Neighbourhood Instrument cross border cooperation programs. Such a funding system can be used for a separate Ukraine-Hungary project for investments and infrastructural developments, using the already implemented techniques of the Egán Ede Program in Zakarpattia. With proper preparation and clarification of the legal conditions it is possible to establish a system that can boost the middle business and the perspective branches of the industries and support the infrastructural projects.

Conclusion

It is about the time to renew the consultations on the possibilities of cooperation between Ukraine and Hungary. Ukraine can build a bridge between Europe in general and Hungary in particular to many Eastern countries and gain the benefits of it. Through the common projects and investments new jobs can be created which is a crucial need especially in the current conditions created by the pandemic – the majority of the Ukrainian guest workers had to head back to their homes where they sooner or later will needed to be employed. As neighbors and partners our aim is to have a strong and prospering Ukraine next to Hungary. It is not a matter of choice who our neighbors are, but we are the ones who choose how to build our relations with them. Ukraine and Hungary might have different positions on certain questions, but today the main goal is not to discuss what divides us, but find that what unites.